Latest News

The Land Price Trend in the Centre of Tokyo~ Forecasting A Rise in Hight Street Rents Over the Next Two Years

2021/11/24

Market Forecast Column

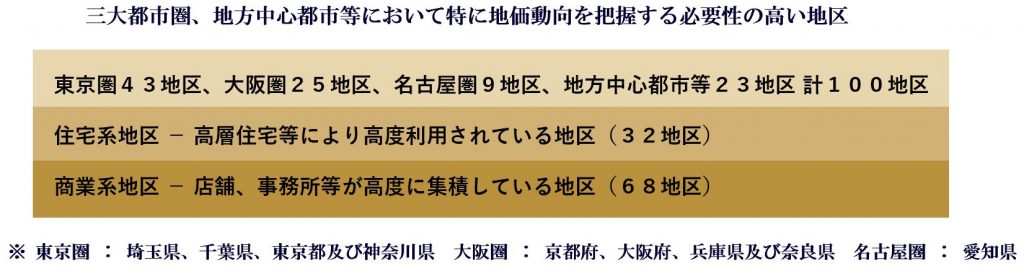

The Ministry of Land, Infrastructure, Transport and Tourism released the “Land Price LOOK Report” (Third Quarter of 2021) on November 19, 2021, summarizing trends in prices of highly utilized areas in major cities. The survey covers a total of 100 districts, including 43 in the Tokyo metropolitan area, 25 in the Osaka metropolitan area, 9 in the Nagoya metropolitan area, and 23 in other regional major cities. Here is a detailed look at the trends in land prices in Ginza and the rental trends of high streets in central Tokyo.

Trends in Land Prices of Highly Utilized Districts in Major Cities

Trends in Land Prices according to the “Land Price LOOK Report”

◆1.Tokyo Area (43)

① 17 districts (previous 14)↑

② 14 districts (previous 18)→

③ 12 districts (previous 11)↓

④ 4 districts (an upward shift in volatility category)

⑤ 1 district (a downward shift in volatility category)

◆2.Residential Area (32)

① 26 districts (previous 24)↑

② 6 districts (previous8)→

③ 0district (previous0)↓

④ 2districts (an upward shift in volatility category)

⑤ 0district (a downward shift in volatility category)

◆3.Commercial Area (68)

① 14 districts (previous 11)↑

② 24 districts (previous 28)→

③ 30 districts (previous 29)↓

④ 4 districts (an upward shift in volatility category)

⑤ 1district (a downward shift in volatility category)

The above information has been reported.

- Target Districts (“Land Price LOOK Report” (Third Quarter of 2021))

Ginza Land Price Trend

Ginza is a presentative commercial district in Japan. Due to limited supply of well-located properties for shops, upper-floor restaurants, and service stores, tenant demand has remained firm, keeping shop rents stable at high levels.

However, the impact of the COVID-19 pandemic significantly reduced the number of foreign tourists and domestic shoppers. During this period, sales of retail stores and restaurants are said to be at low levels.

Nevertheless, with the lifting of emergency declarations and progression in vaccination, gradual recovery in foot traffic can be expected.

According to a report by the Ministry of Land, Infrastructure, Transport and Tourism, in the rent market, while vacancies persist particularly in upper-floor shops, demand remains strong for street-front shops in good locations, especially among brand stores. Therefore, there has been no significant change in overall vacancy rates, and shop rents have generally remained flat.

In the transaction market, there has been a noticeable presence of buyers showing strong interest in properties in a favorable financial environment.

However, sellers are not rushing to sell, and the shortage in property supply for sale continues.

Additionally, since transaction yields remain flat, current land price trends are analyzed to have remained stable.

Amidst ongoing market uncertainties due to the impact of COVID-19, the lifting of the emergency declarations is expected to lead to increased costumers and personal consumption. However, the current market is predicted to persist.

Therefore, future land prices are expected to remain flat.

Ginza High Street Rent Expected to Rise by 2.1% over the Next Two Years

CBRE, a leading real estate service provider, has summarized rental trends for areas lined with luxury stores.

According to it,

◆Tokyo-Ginza High Street Rent in Third Quarter of 2021

・241,500 yen (Monthly rent per tsubo decreased by 4.7% compared to the same period last year)

The decrease amounted to 30.2% compared to two years ago with a rush of consumption before the consumption tax increase.

While there is a demand for luxury brand store openings, the momentum is weak in areas where domestic retailers are concentrated. Therefore, rent levels are predicted to rise by 2.1% over the next two years.

◆Omotesando and Harajuku Areas High Street Rent

・173,800 yen (monthly rent per tsubo remains unchanged compared to the same period last year)

Properties with relatively large sizes located in Meiji Street have lower appeal for opening stores due to high rental amounts. On the other hand, there is some interest in properties with unit rent prices below the market or with flexible rental conditions.

◆Shinjuku Area High Street Rent

・172,000 yen (monthly rent per tsubo decreased by 3.1% compared to the same month last year)

While the main reason for the lower rent is due to locations away from luxury brand stores, reported rent levels by retailers are comparable to market rates.

◆Shibuya High Street Rent

・126,800 yen (monthly rent per tsubo decreased by 0.7% compared to the same month last year)

This slight falling is due to increased supply relative to store opening needs.

Next, GLOCALY will introduce selected properties in the market of new condominiums.

Property Picked up by GLOCALY

This rare property has an exceptionally prime location, just a two-minute walk to Higashi-Ginza Station and a 5-minute walk to Ginza Station.

The predicted 4.2% gross yield at this location is attractive. Currently, it is possible to sell only the land.

For more information