Latest News

Japan’s Real Estate Market Enters an Era of “Moving While Being Chosen”

2026/2/10

Brief Knowledge of Japanese Real Estate

The latest real estate data released by Japan’s Ministry of Land, Infrastructure, Transport and Tourism(MLIT) indicates that the Japanese property market is gradually entering a new phase.

Overall transaction activity is recovering. However, a closer look reveals widening differences between central urban areas and other regions, as well as between different property types.

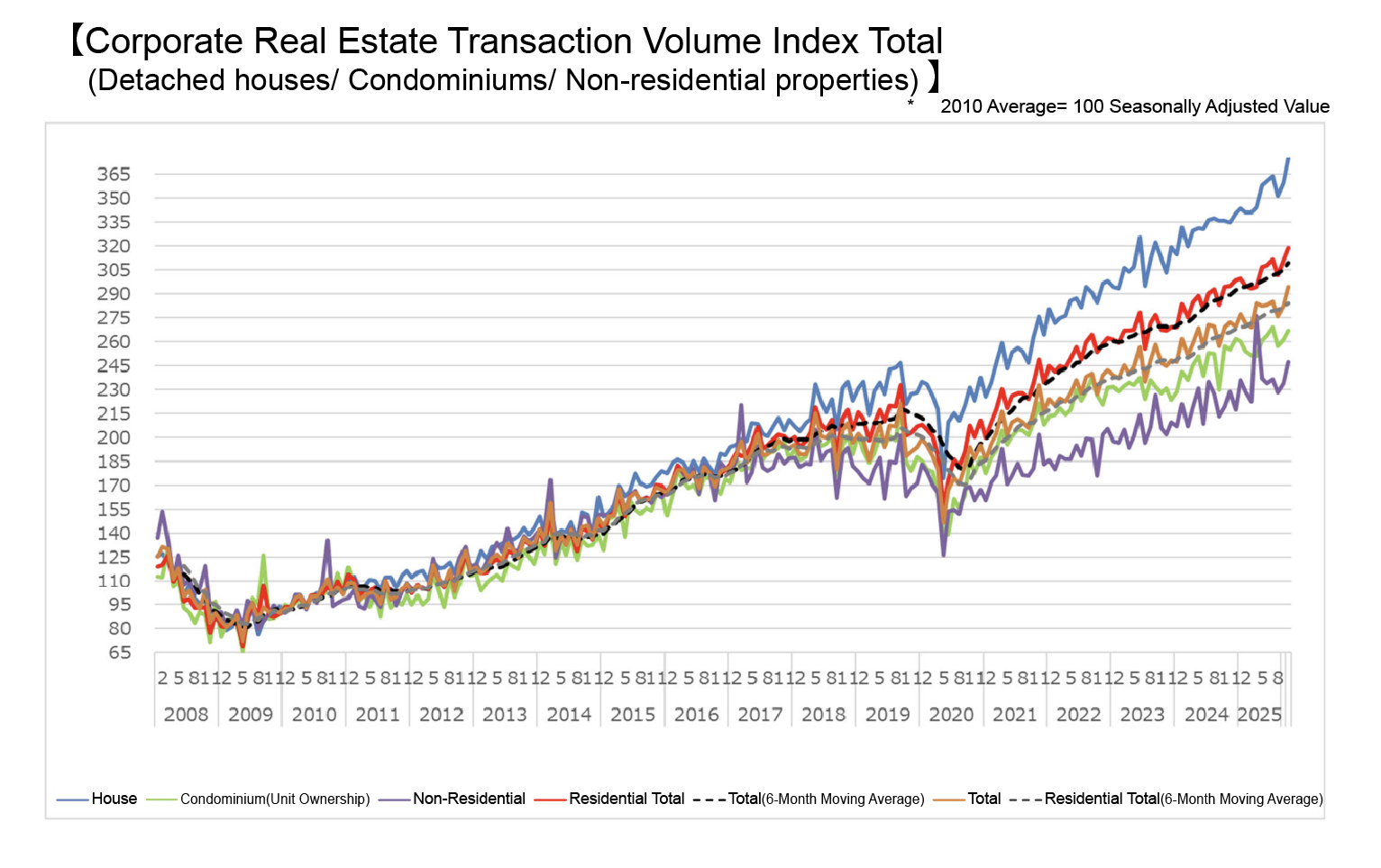

First, corporate-related real estate transactions across the nation increased by more than 4% compared to the previous month. Deals involving offices and commercial properties are clearly picking up.

Yet, regional trends differ.

In the three major metropolitan areas, transactions for detached houses and business-use properties remain relatively steady, while condominium sales are struggling. In central Tokyo especially, high price levels have made buyers more cautious.

In contrast, outside the major urban regions, transaction volumes are rising more clearly in many sectors. Since prices have not surged as sharply as in the city center, demand driven by actual residential needs remains strong.

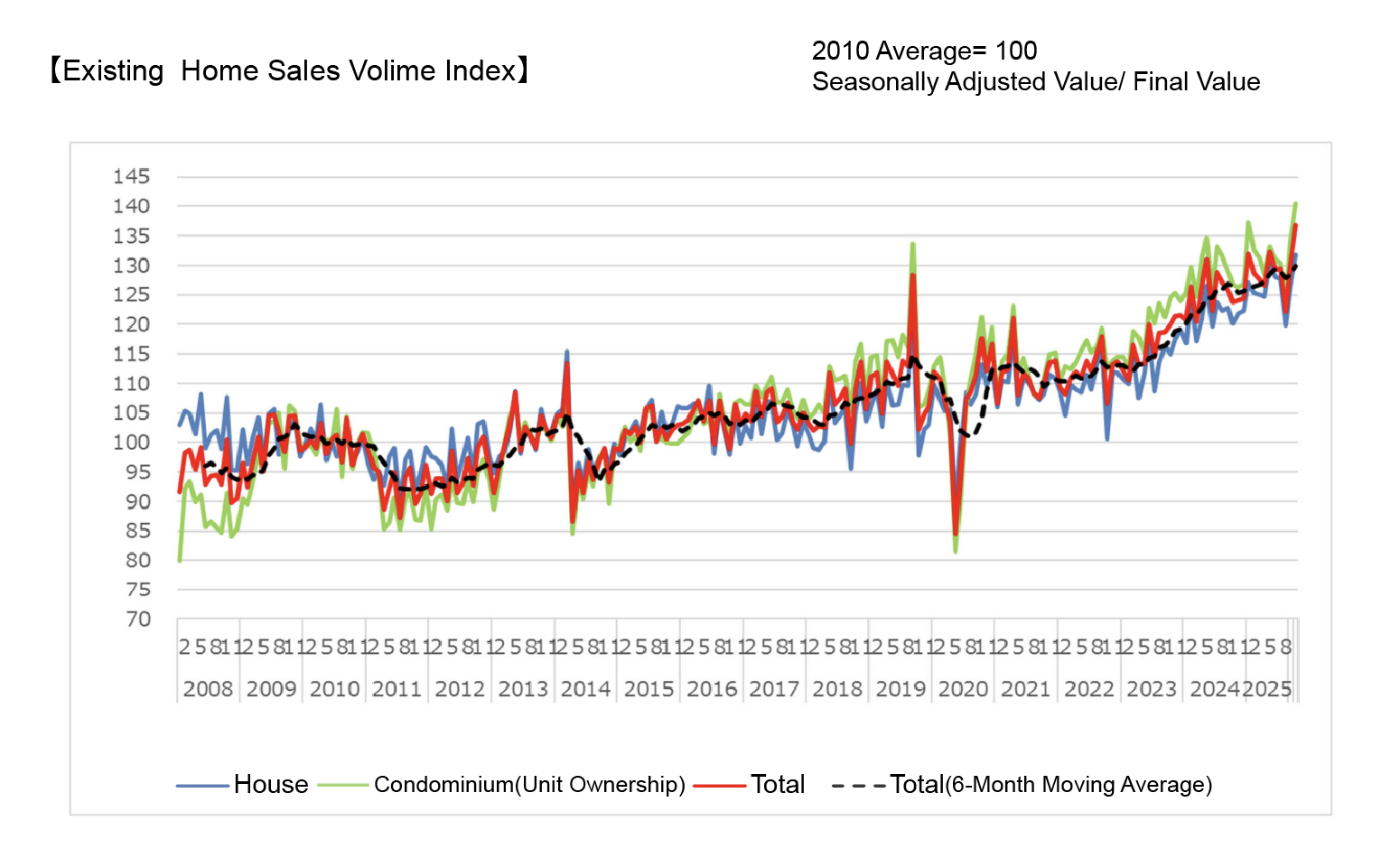

This pattern is also evident in the resale housing market.

In the Kansai region, transactions have increased significantly. Osaka Prefecture, in particular, is seeing active sales in both houses and apartments. Meanwhile, in the Tokyo metropolitan area, transactions are increasing but at a slower pace.

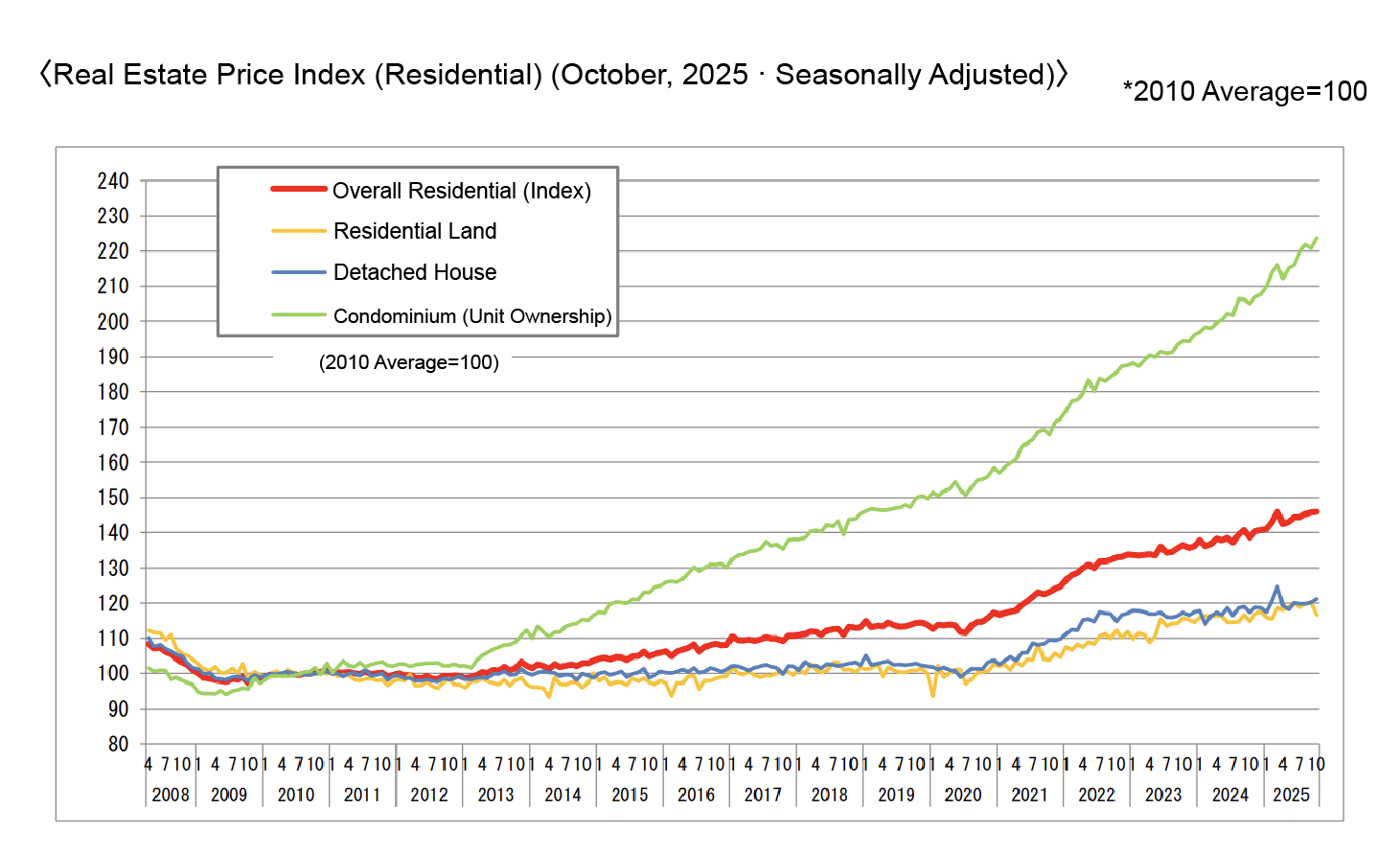

Price differences between central Tokyo and other regions are becoming even more pronounced.

In Tokyo, overall housing prices have slightly declined, and land prices have adjusted more noticeably. This suggests that prices had risen too far, prompting buyers to act more cautiously.

On the other hand, Osaka and many regional cities are experiencing rising home and land prices. With less overheating than Tokyo, demand appears to be shifting toward areas where prices better reflect real conditions.

In other words, today’s market is seeing two trends progress simultaneously:

- In central urban areas: selective buying at high price levels

- In other regions: stronger movement supported by relative affordability

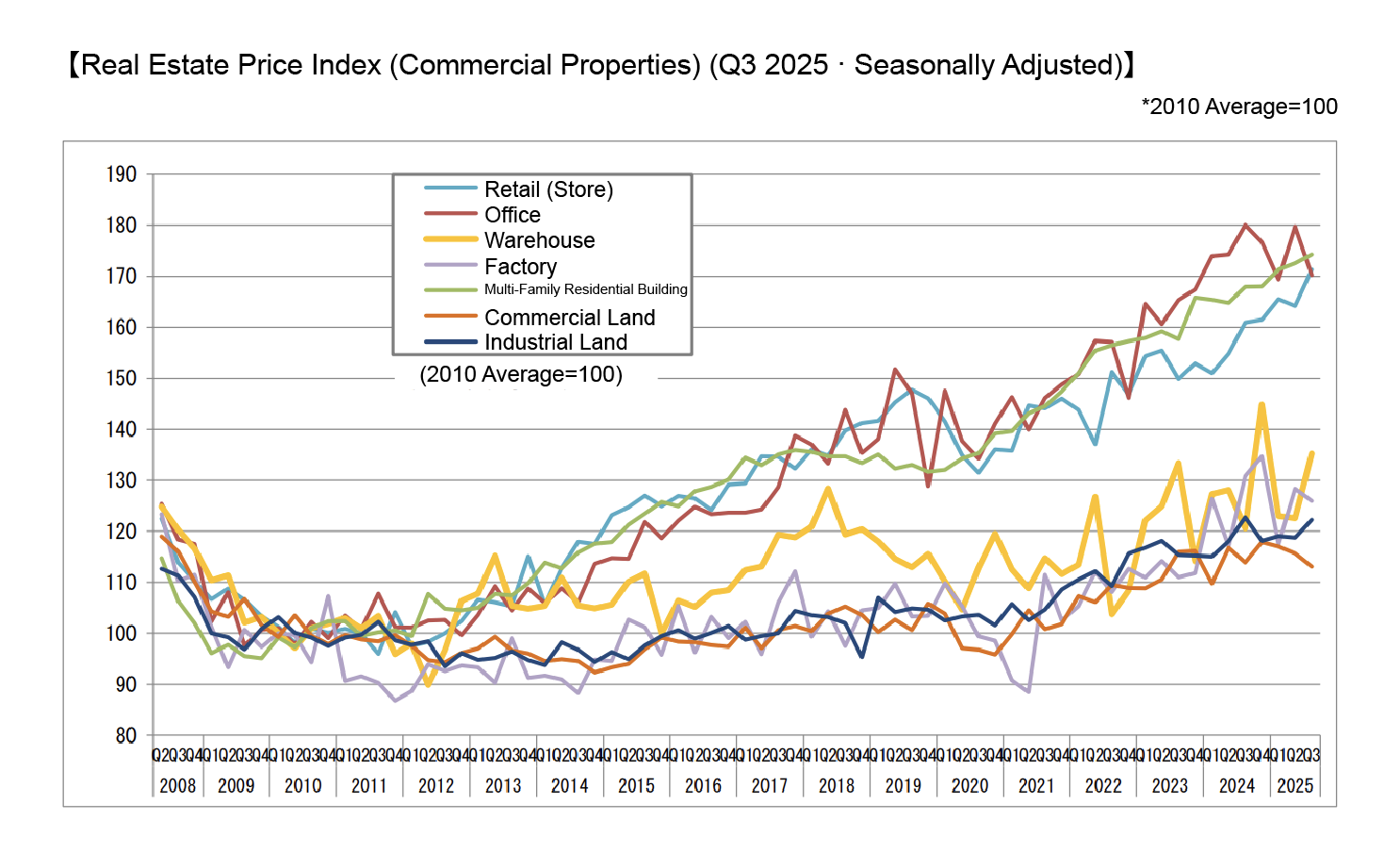

The contrast is also clear in commercial real estate.

Office demand in major city centers is slowing, while logistics warehouses and industrial land remain in high demand nationwide. With the growth of e-commerce and supply chain restructuring, warehouses are becoming essential properties regardless of location.

Alongside these market changes, an important institutional reform is also underway.

Starting April 2026, corporations conducting large-scale land transactions will be required to report the nationality of their representatives and key decision-makers.

This framework aims to clarify who is purchasing land and the intentions behind its use. Particularly in major cities and strategically important areas, land-use intentions will be scrutinized more closely.

There is no direct procedure for ordinary residents, but in the long run, this may help curb opaque transactions and extreme price swings, contributing to market stability.

For people considering buying or moving homes, the key is no longer simply comparing “city versus countryside.”

What matters is whether the location will remain livable and continue to be chosen in the future.

Population trends, transportation access, infrastructure, and regional development plans—carefully evaluating these factors will become essential for making sound real estate decisions and protecting household finances.

Large-scale land definition:

- Urbanized areas: 2,000㎡ or more

- Other city planning areas: 5,000㎡ or more

- Outside planning areas: 1 hectare (10,000㎡) or more

For more information