Latest News

Basic Knowledge of Home Loans: Interpreting Mechanisms of Interest Rates!

2021/12/7

Brief Knowledge of Japanese Real Estate

Do you know the detailed information concerning home loans?

Currently, home loans are the most common way that Japanese purchase a home domestically.

However, many may feel difficult in investigating the details of those home loans and making their own decisions on which financial institution and what type of home loan they should choose.

There are various ways. Some people decide on financial institutions and home loan products based on real estate agents’ suggestions. Others may consult with their insurance agents or financial planners (FP).

Consulting with the latter (insurance agents or FP) is safer to some degree. However, frankly speaking, blindly following the recommendations of real estate agents’ or real estate owners’ representatives is a very risky move to take out a home loan.

The reason is that real estate agents or real estate sellers are in a position where they want to sell the property. They are the so-called stakeholders in the transaction.

In other words, their primary goal of gaining profit through selling the property or completing contraction is in a position completely opposite to yours as the prospective buyer aiming to contract a home loan and make the purchase.

On the other hand, insurance agents or FPs take a different approach. They objectively assess the possible impact of the real estate transaction on your future life, analyze the potential benefits and drawbacks. They gain profit by providing strategies to address the future necessity and risks.

In brief, they are the non-stakeholders in the contraction.

However, it’s worth noting that insurance agents or FPs vary significantly in their knowledge and experience. Therefore, it cannot simply say “You can consult with anyone.”

To ensure that you receive accurate information from appropriate sources, you should have some knowledge. After all, as a prospective buyer who will contract a home loan and become a debtor, you must protect your money.

The introduction is lengthy. This column will explain the basics of “Home Loans” in three sections.

The First Section

- What is a Home Loan?

- About Home Loan Interest Rates

This section is going to discuss ① What is a Home Loan? ② About Home Loan Interest Rates.

◆1. What is a Home Loan?

A home loan refers to the financing provided by financial institutions for the purchase of a house for self-residence.

Financial institutions will acquire a mortgage on the house in exchange for offering individuals low interest rates and long-term financing for their home purchases.

The mortgage is a right on real estate owned by an individual (the debtor) who borrows a loan. In detail, if the debtor becomes unable to pay off the loan, the financial institution (the creditor) can foreclose on the property and receive repayment priority from the sale proceeds.

In addition, each financial institution will provide favorable conditions for debtors such as low interest rates and repayment periods of up to 35 years. These loans can only be used to purchase self-or family-residence real estate. Consequently, in principle, one contract is allowed for only one person.

Home loan can be broadly categorized into two types. The first is “Bank loans,” provided independently by banks and other financial institutions. The second is “Flat 35,” provided by Japan Housing Finance Agency together with private financial institutions.

◆2.About Home Loan Interest Rates

Home loans can be broadly divided into two types: “Fixed interest rate ” and “Variable interest rate.”

If you are unsure whether to choose a “Fixed interest rate ” and “Variable interest rate,” please refer to the followings.

Let’s start from the conclusion.

“Fixed interest rate” is suitable for

・ Families in the child-rearing stage, where future unexpected expenses, including children’s tuition, are a concern

・Persons who struggle with financial calculations, investments, or savings

・Dual-income families where there isn’t much extra money available for life-planning savings and investments

・Persons who want to feel secure by stabilizing and fixing future housing costs

“Variable-rate interest” is suitable for

・Persons who currently have extra money for savings and investments to build their assets

・Persons who frequently monitor information of financial market and grasp interest rate trends

・Persons who plan or are considering to sell their homes within 10 years after purchase

・Persons who are able pay off a part or all of the loan when interest rates enter an upward trend

Now, Let’s further and briefly explain interest rate types.

“Fixed interest rate type”

“Fixed interest type” has no relationship with the future interest rate fluctuations, characterized by stabilized future loan repayment and the easy planning of finances since the interest rate has been fixed in the contract .

The aforementioned “Flat 35” is a representative example of home loans with fixed-interest rates for the entire duration.

Flat 35 is a type of home loan product offered by banks or mortgage banks.

Japan Housing Finance Agency, an independent administrative agency, is the practical lender since it has purchased loan obligation intending for home buyers from these financial institutions.

Furthermore, the Japan Housing Finance Agency securitizes the acquired loans and sells them through the bond market in the form of “Agency Bonds (RMBS – Residential Mortgage-Backed Securities).” Therefore, the interest rate of Flat 35 is determined by adding the interest rates of the Housing Finance Agency and the financial institutions selling Flat 35 to the base interest rate of these “Agency Bonds.” To simplify this somewhat complex explanation, it would be best to remember that it is “linked to the yield of newly issued 10-year government bonds.”

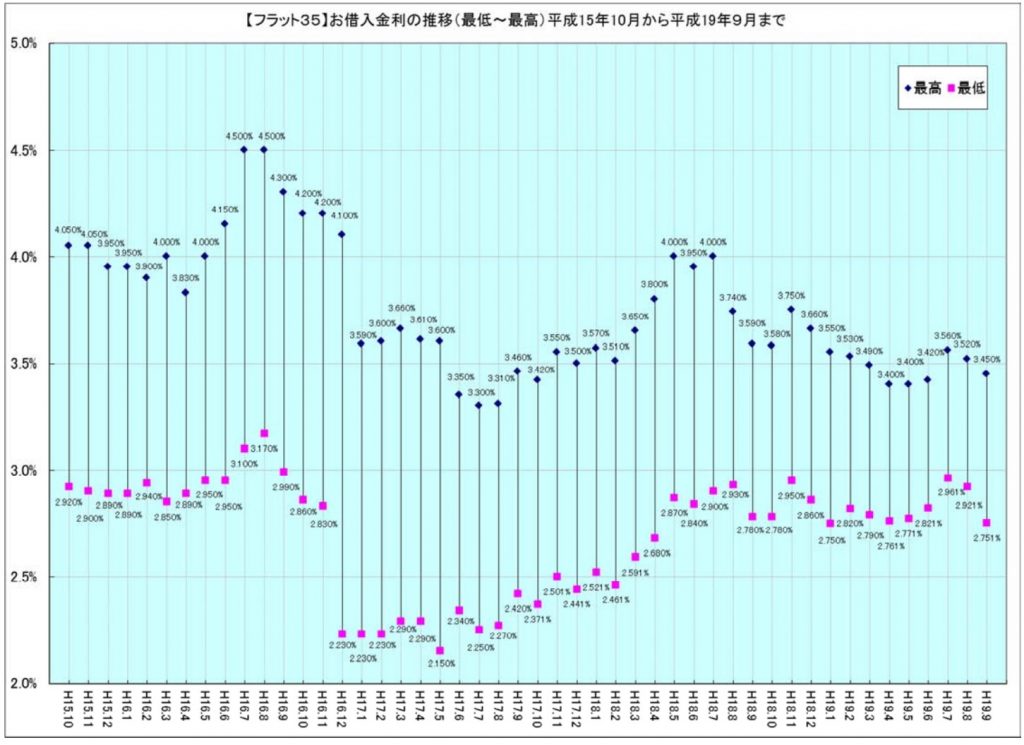

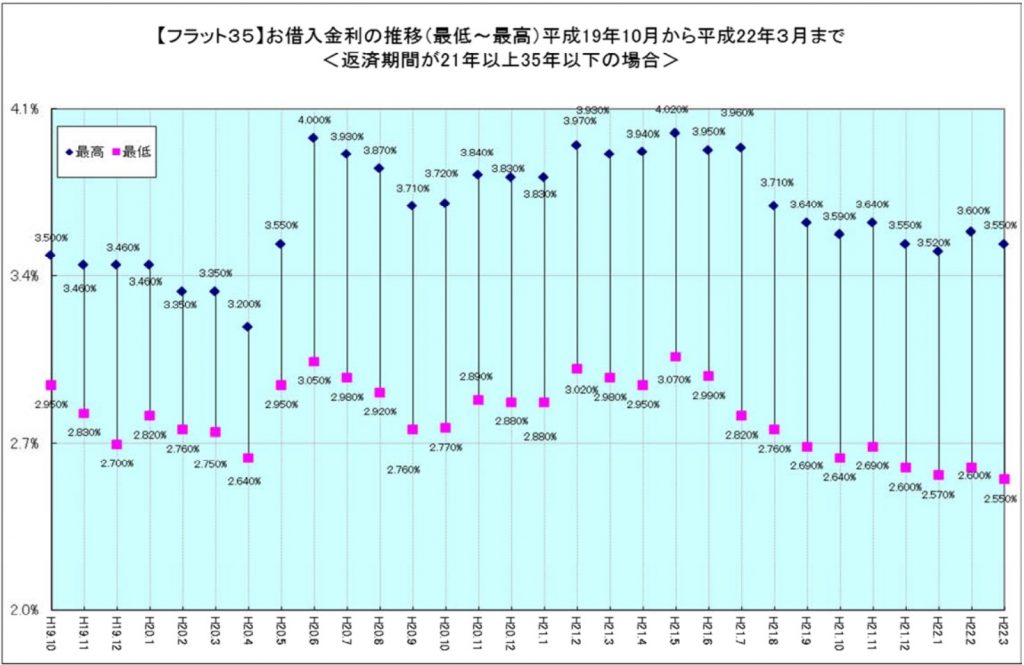

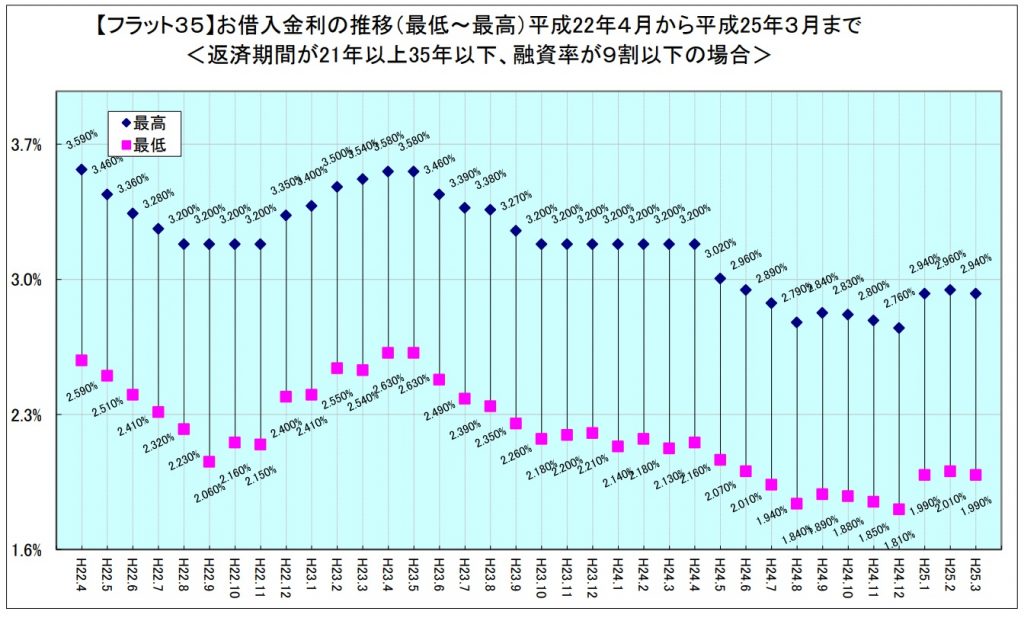

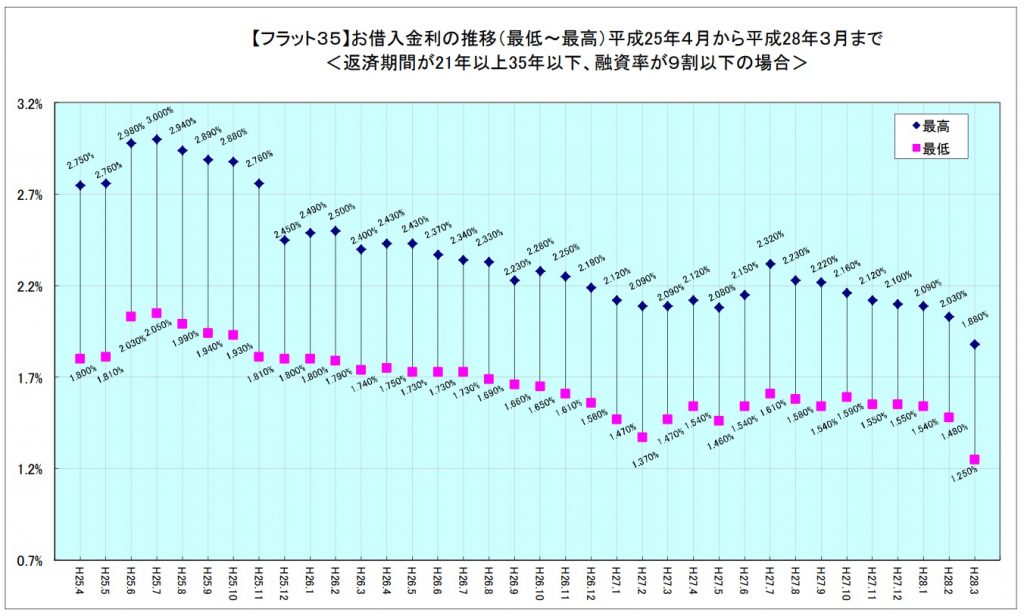

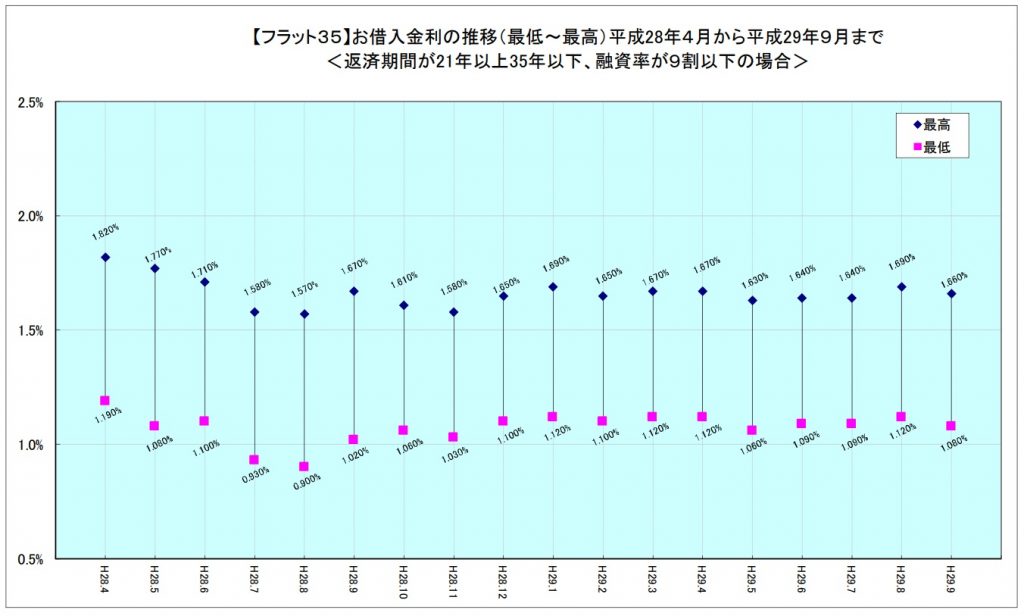

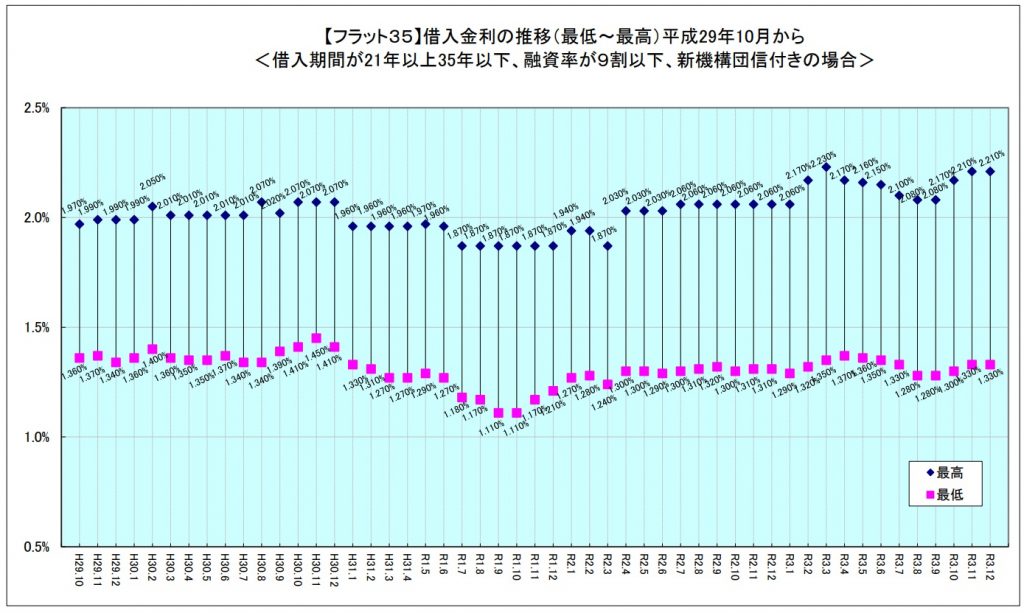

In December, 2021, the interest rate provided by Flat 35 is 1.33% per year for financing rates of up to 90%.

This can be demonstrated by a very low level of interest rates, even when looking at the trend since around 2003.

“Variable interest rate type”

“Variable interest rate type” is a type that the applied interest rate changes during the borrowing period. Generally, the applied interest rate will be revised every six months after borrowing.

The applied interest rate of variable interest rate is closely related to short-term prime rate.

The short-term prime rate is decided by Bank of Japan‘s interest rate policy, that is “the interest rate applied by financial institutions when lending to prime borrowers for short-term (less than 1 year) loans.”

In brief, since the policy of Bank of Japan is connected with the interest rate, the rate rises when the economy improves, and it falls when the economy weakens.

Therefore, there is a risk that during the borrowing period, the monthly repayment amounts will increase if the applied rate rises. However, some financial institutions can apply rules such as “5-year rule” or “125% rule.”

While these rules seems friendly to debtors at the first sight, caution is required due to unexpected traps.

Moreover, due to the current market conditions where short-term rates are lower than long-term rates (Normal Yield), many variable interest rates of home loans provided by banks an others are lower than long-term fixed rates like Flat 35. This is advantageous as it allows for faster repayment of the loan.

The above is the first column that has summarized the information concerning the home loan. If you are interested in this aspect or want to know further about it, please contact us freely through the inquiry form.

Please wait for the second column.

For more information