Latest News

Latest Office Building Market~ Impacted by COVID-19, Slight Increase in Vacancy Rates in Central Tokyo

2021/11/18

Urban Planning and Redevelopment Area Information

What is the latest office building market like in Tokyo’s business districts? There has been a slight increase in vacancy rates due to the impact of COVID-19. Please take a closer look at the market for Tokyo metropolitan office buildings in the October 2021.

Impacted by COVID-19, A Consecutive Two-month Increase in Vacancy Rates in Tokyo’s Central Five Wards

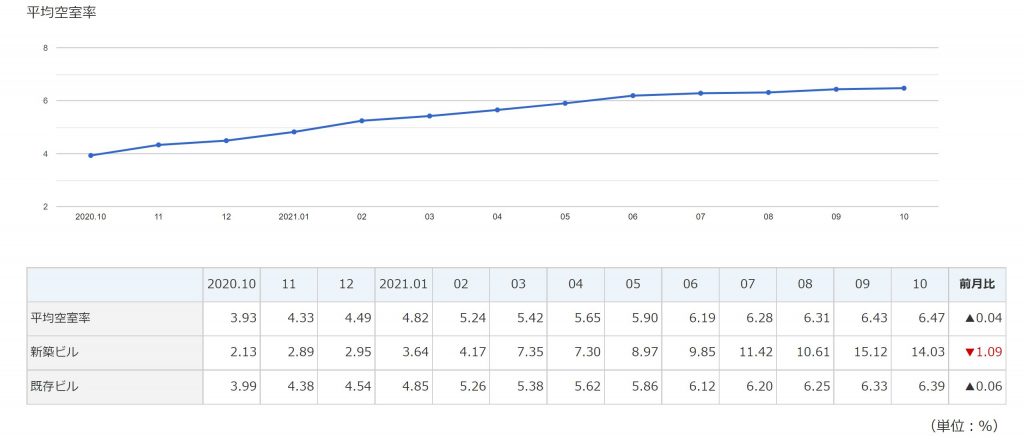

According to MIKI OFFICE REPORT (Miki Company), the average vacancy rate in Tokyo’s business districts (the central five wards: Chiyoda, Chuo, Minato, Shinjuku, and Shibuya) was 6.47%, increasing by 0.04 points compared to the previous month.

The month of October saw movements such as large-scale cancellations of contracts due to downsizing within buildings; however, there were also movements in leasing of medium and small offices due to integrations, resulting in only a slight increase in vacancy rates in Tokyo’s business districts.

In October, the vacant rate for newly constructed buildings was 14.03%, decreasing by 1.09 points from the previous month. Since there were no new completions of buildings in October and some completions of small-scale contracts were observed, the vacancy rate decreased. The vacancy rate for existing buildings in October was 6.39%, increasing by 0.06 points compared to the previous month.

(Source: Miki Company Tokyo Business Districts/Latest Market https://www.e-miki.com/market/tokyo/)

5% Predicted Oversupply, Consecutive 9-Month Increase

District variations in office demand led to a slight increase in vacancy rates.

By district, the vacancy rate in Chiyoda Ward was 4.78%, up by 0.17 points and in Shinjuku Ward 6.79%, up by 0.66 points from the previous month.

It is believed that the decrease in office needs from major financial institutions in Chiyoda and Shinjuku had influenced the vacancy rate. On the other hand, the vacancy rate in Shibuya was 5.89%, decreased by 0.86 points, due to the robust demand from IT (information technology) companies.

This decrease rate in vacancy rates is the largest among the five wards, controlling the rise space of the overall vacancy rates in central Tokyo.

(Source: Miki Company Tokyo Business Districts/Latest Market https://www.e-miki.com/market/tokyo/)

(Source: Tokyo Business Districts/Latest Market https://www.e-miki.com/market/tokyo/ )

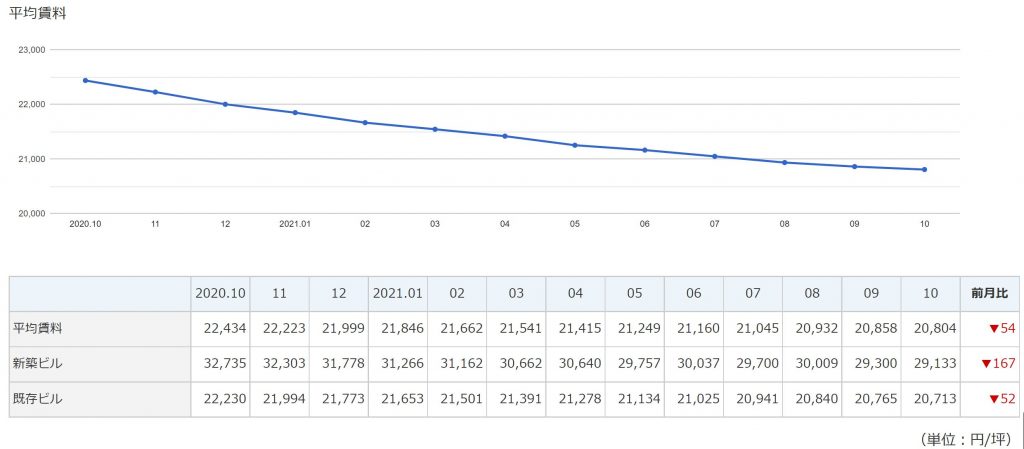

Consecutive15-Month Decreases in the Average Rent in Tokyo’s Business Districts

The average rent per 3.3 square meters was 20,804 yen, decreased by 7.27% (1,630 yen) compared to the same month last year, decreased by 0.26% (54 yen) compared to the previous month.

The average rent for Tokyo’s business districts has been decreasing for 15 consecutive months.

(Source: Miki Company Tokyo Business Districts/Latest Market https://www.e-miki.com/market/tokyo/)

Next, we present noteworthy new condominiums strictly selected by GLOCALY.

GLOCALY’s Pick-Up Property

■Excellence Building Sakuragaoka Cho (For investment, Completion in progress)

This rare and prime location is only a 5-minute walk from Shibuya Station, a terminal station undergoing significant transformation.

The property boasts a wide 30-meter frontage in one of the most popular areas.

Its exceptional visibility makes it ideal for attracting tenants for office and shop uses.

Its proximity to Shibuya Station, a big terminal station, and redevelopment zone make it a highly profitable investment with high asset value.

For more information