Latest News

Although the global epidemic is uncertain, the real estate market is expected to recover

2021/12/8

Market Forecast Column

Covid-19, which has swept the world for nearly two years, has brought different economic losses to many countries, but in most countries and regions, the economy has begun to rebound, and the real estate industry has also seen signs of demand recovery.

According to Jones Lang LaSalle’s survey, the office market net absorption turned positive for the first time since the onset of the pandemic, while demand for logistics space has continued unabated. The recovery in retail and hotels is very market and sub-sector specific but some promising signs are emerging. Overall, sentiment and forward-looking indicators all point towards the recovery in economic and occupier activity being sustained and expanding through the next year.

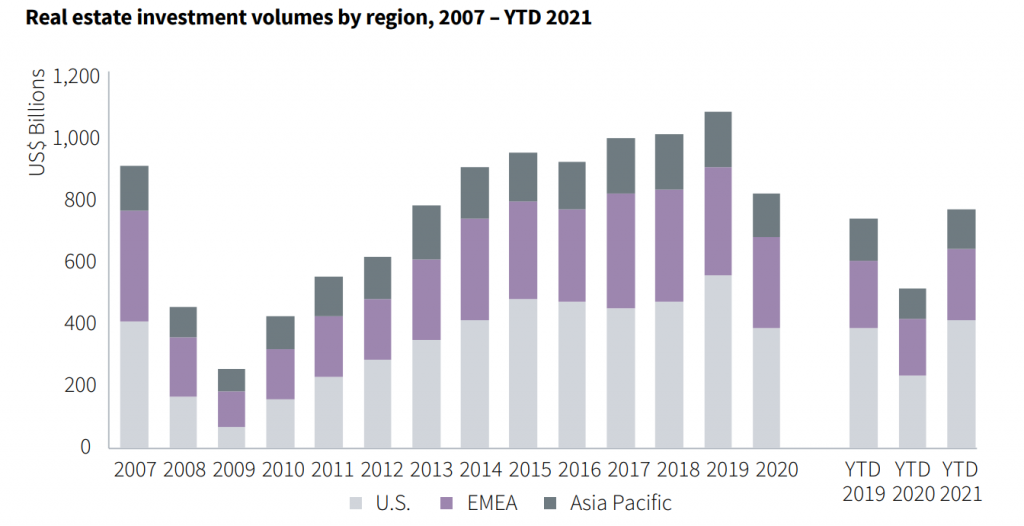

Commercial real estate investment amount by region

According to investment analysis, the amount of investment in world commercial real estate from January to September 2021 increased by US$757 billion from the same period last year, reaching 50%, and the third quarter of 2021 increased by 292 billion from the same period last year, reaching 77%.

The outlook for the Japanese real estate market is optimistic

Regarding the Japanese real estate market, the epidemic has made locals more willing to stay at home, and even need more living space for working from home. According to REthink Tokyo’s “2022 Asia-Pacific Real Estate Emerging Trends” reports that Japan’s stable political situation, low interest rate environment, and high vaccination rate are very beneficial to Japan’s economic growth and the prospects of the property market next year. At present, many overseas investors are keenly interested in Japanese properties and express their interest in buying Tokyo properties.

The report shows that the current leasing risk in the Japanese property market is low, and there is also the potential for rents to rise. First, in terms of mortgage interest rates, if you are a local citizen with a stable income or a permanent resident, you can apply for a full loan with a mortgage interest rate ranging from 0.5% to 1%; if you are an overseas investor, the mortgage interest rate is 2% to 3%. It is still a lower borrowing cost. Because the epidemic has caused changes in people’s lives, they have more time at home, and many tenants are looking for larger areas or additional space for home offices, etc., which will benefit the local property market in the long run.

The real estate market in Japan will recover rapidly as a result

In addition, Savills’s “Asian Real Estate Market in 2030” research report shows that although the epidemic has affected Japan’s hotel, retail, and tourism industries and has weakened the economy, the agency is still optimistic about the prospects of the Japanese property market in the long run. Because Japan is the world’s third largest economy, it is expected that there will be no major changes in Japan’s policies in the days to come.

In terms of the epidemic, currently about 77% of the vaccinated population in Japan has been vaccinated. The average number of infections has recently dropped to less than 100 cases per day. The research report believes that the real estate market in Japan will recover rapidly as a result, driving the increase in the housing market. In recent years, Tokyo, Osaka, Nagoya and Fukuoka are all cities where overseas investors are keen to invest.

GLOCALY picked up excellent investment property

“Excellence Building Sakuragaokacho” is located in the Shibuya redevelopment zone, which is a highly visible area in Tokyo with the potential for high return. This commercial building is constructed of reinforced concrete, with 2 floors above ground and 1 floor underground.

“Excellence Building Sakuragaokacho” is expected to be completed by the end of February 2022, and the recruitment of tenants has begun in November 2021. We expect that “Excellence Building Sakuragaokacho” will maintain high returns in the foreseeable future and is an asset with appreciation potential.

For more information