Latest News

Real Estate Market Recovery Trend — Analysis of May 2025 Sales Volume Index and Q1 Price Index

2025/9/10

Urban Planning and Redevelopment Area Information

Market Overview

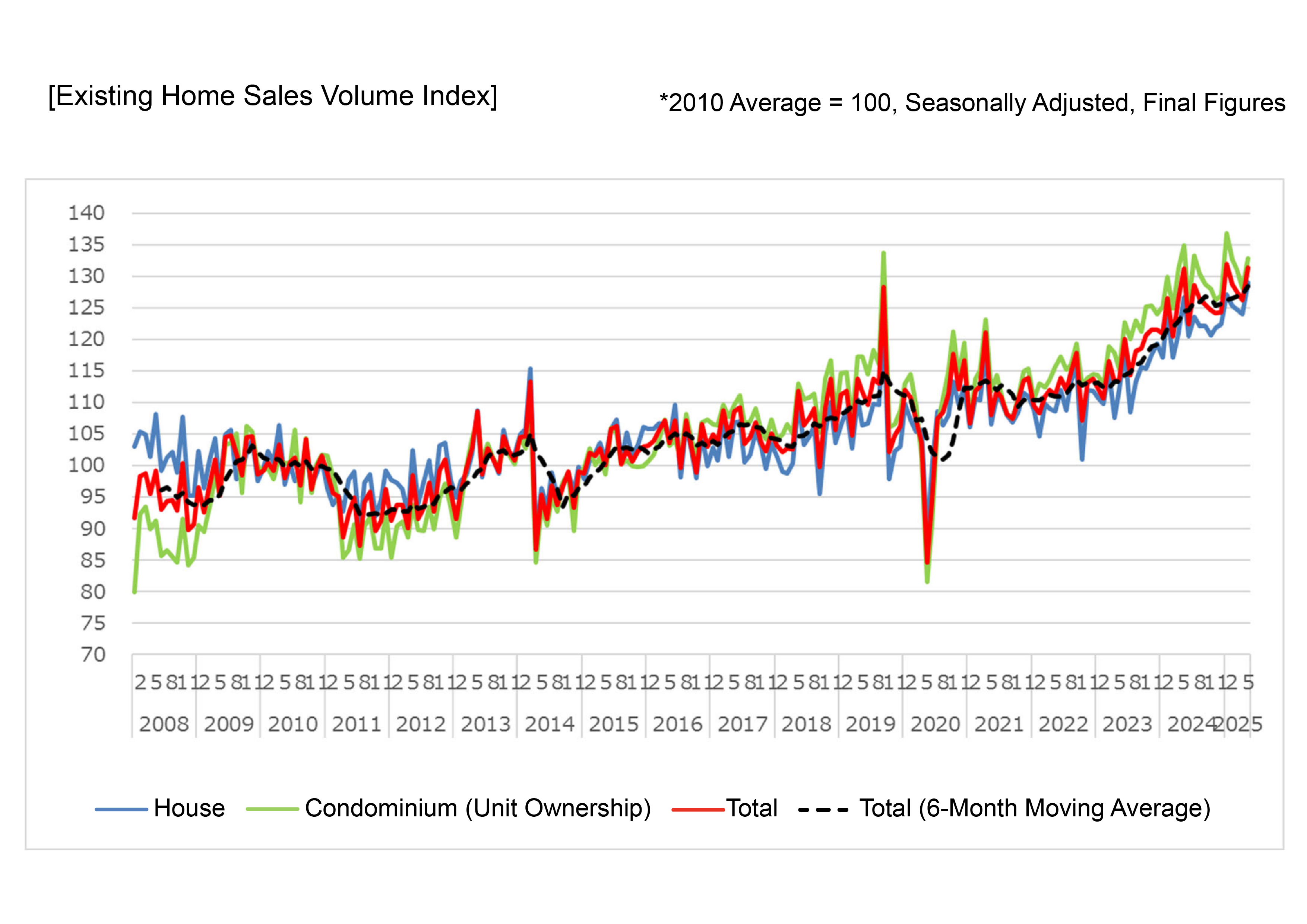

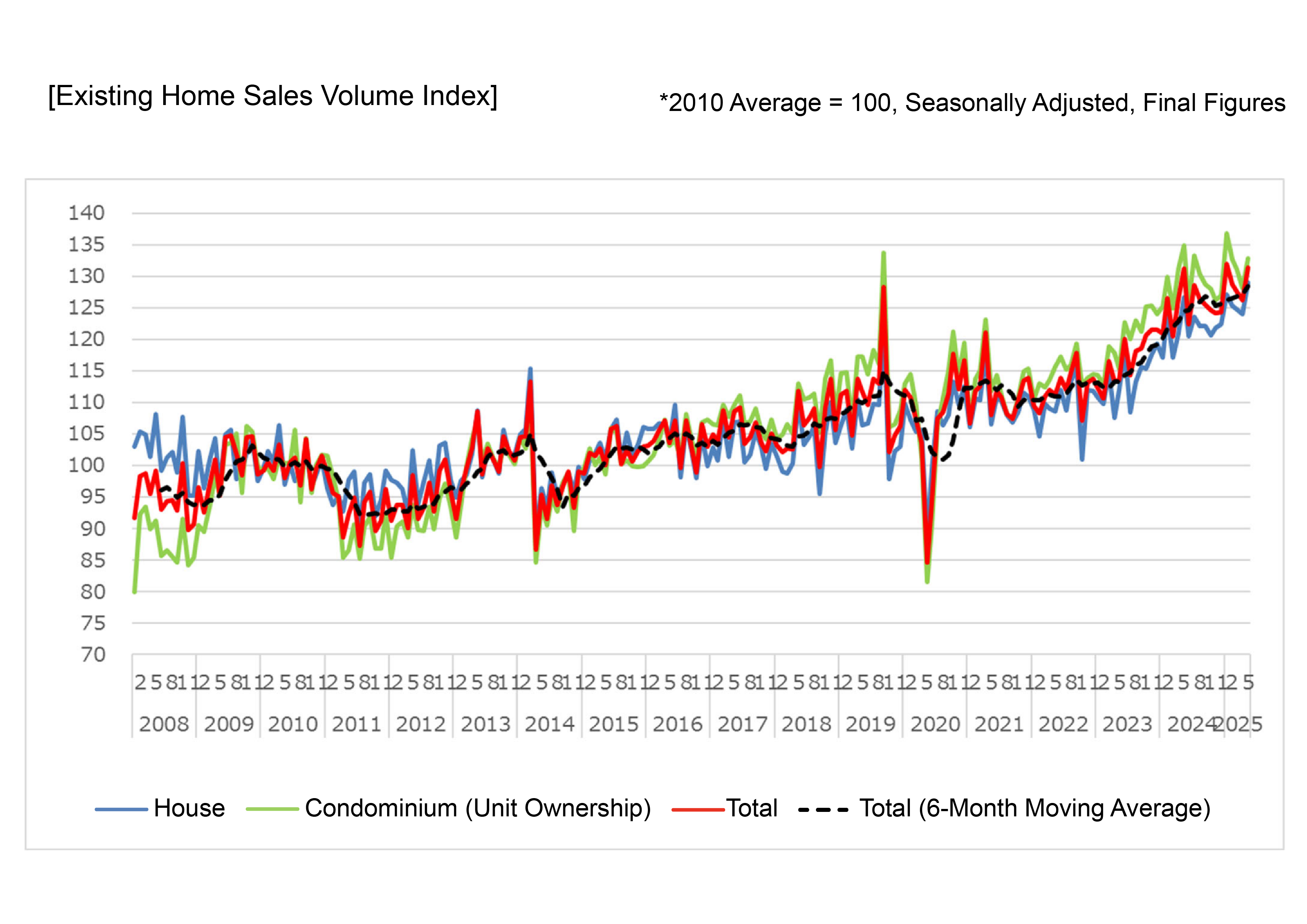

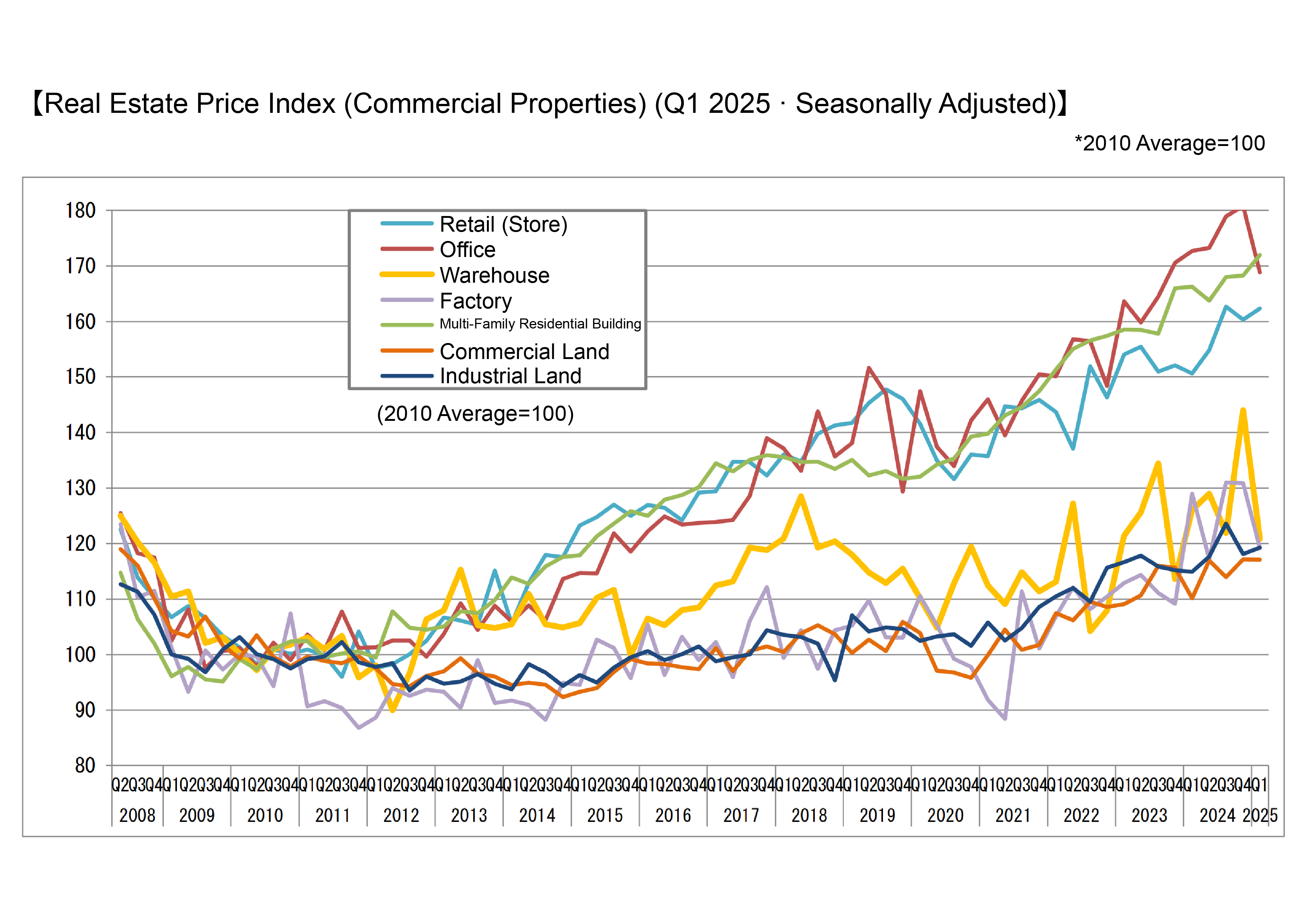

The May 2025 Existing Home Sales Volume Index and Q1 Real Estate Price Index indicated a moderate nationwide recovery. Condominium markets were particularly strong, with notable growth in major metropolitan areas such as Tokyo and Osaka. Conversely, commercial real estate showed weakness in the office sector, highlighting divergence across asset classes.

Existing Home Sales Volume Index: Condominiums Lead

Nationwide: +4.2% (131.4); excluding <30m²: +5.0% (120.0)

Detached houses: +4.1% (129.0)

Condominiums: +3.6% (132.8); excluding <30m²: +4.3% (107.9)

Regional highlights: Tokyo (+4.7%; condos +5.1%), Osaka (+2.4%; condos +2.8%), Kanto (+4.1%; condos +6.4%), Kansai (+4.6%; detached +7.2%, condos +3.8%).

Investor Takeaway:

Even when excluding compact units, demand is expanding, including family-sized properties. Urban condominiums remain highly liquid, offering attractive short- to mid-term investment opportunities.

Real Estate Price Index: Strength in Urban Condominiums

Nationwide: +0.3% (143.0)

Residential land: +1.1% (118.6)

Detached houses: -1.1% (117.3)

Condominiums: +1.7% (216.4)

Tokyo: total +2.4% (177.9); condos +4.2% (229.6)

Osaka: total +1.7% (154.4); residential land +12.7% (130.8); condos +2.8% (216.9)

Investor Takeaway:

Tokyo and Osaka condominiums offer both capital gain and rental income potential. In contrast, detached houses face price softness and higher vacancy risk in depopulating areas.

Commercial Real Estate Index: Office Weakness

Nationwide: -0.2% (144.8)

Retail: +1.3% (162.3)

Multi-family/apartment buildings: +2.2% (171.9)

Offices: -6.6% (168.8)

In major metro areas: retail +2.7%, commercial land +4.7%, while offices (-7.6%), warehouses (-11.2%), and factories (-6.8%) all declined.

Investor Takeaway:

Office demand remains under pressure, requiring selective investment. Conversely, retail, commercial land, and residential rental assets show resilience, driven by inbound demand and redevelopment.

Investment Strategy Recommendations

Urban Condominium Investment:

Tokyo/Osaka units remain liquid, suitable for long-term holding.

Residential-Type Commercial Real Estate:

Multi-family/apartment assets provide stable rental income.

Retail & Commercial Land:

Benefiting from tourism and redevelopment projects.

Offices:

Proceed with caution; focus on selective assets or conversion opportunities.

Overall Assessment

The housing market continues to be condominium-driven, especially in major cities. Meanwhile, commercial real estate is undergoing an adjustment phase led by office weakness. A balanced portfolio centered on urban condominiums, commercial land, and residential rental assets is recommended.

For more information