Latest News

The Era of Selective Real Estate”: Signs of Change Shown in the July 2025 Data

2025/11/10

Market Forecast Column

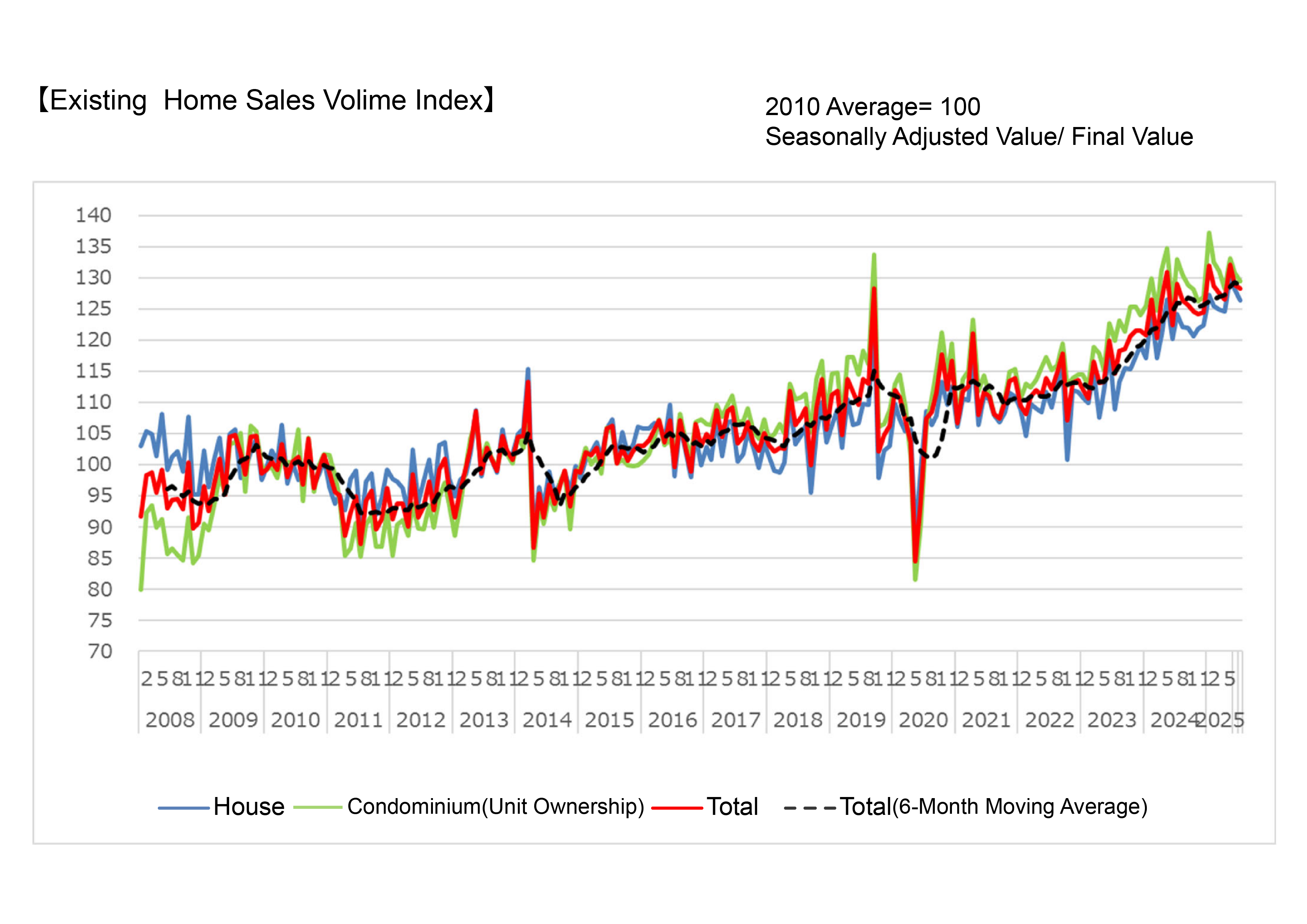

July 2025 Existing Home Sales Index: Slight Decline Nationwide, Tokyo Area Softens

According to the Ministry of Land, Infrastructure, Transport and Tourism, Japan’s Existing Home Sales Volume Index for July 2025 (seasonally adjusted) was 128.3, down 0.4% from the previous month, showing a slight nationwide decrease. Excluding units under 30m2, the total index was 116.4 (down 1.4%), indicating a slowdown in both detached house and condominium transactions.

By housing type, detached houses stood at 126.4 (down 1.3% year-on-year) and condominiums at 129.4 (down 1.0% month-on-month). Notably, larger condominiums (over 30㎡) dropped to 103.7 (down 2.6%), suggesting that rising prices may have curbed demand.

Regional Trends

In the Kanto region, the total index was 129.3 (down 1.2%), exceeding the national decline. Detached houses registered 131.3 (down 0.7%), and condominiums 128.0 (down 1.3%). Excluding smaller units, condominium sales dropped to 102.8 (down 2.4%), reflecting continued weakness in small-unit transactions in central Tokyo.

Conversely, the Kinki region rose slightly to 128.0 (up 0.9%). Detached houses declined to 109.2 (down 1.9%), while condominiums increased to 145.8 (up 0.9%), supported by investment demand. However, larger condominiums fell to 100.2 (down 3.6%), indicating persistent adjustment in the owner-occupied segment.

By prefecture, Tokyo’s total index was 145.2 (down 1.6%), with detached houses sharply down to 124.0 (down 5.6%) and condominiums at 150.4 (down 1.3%). Osaka recorded 134.2 (down 2.3%), with condominiums at 165.4 (down 2.0%) and large units plunging to 94.5 (down 9.6%), signaling clearer correction in Kansai urban centers.

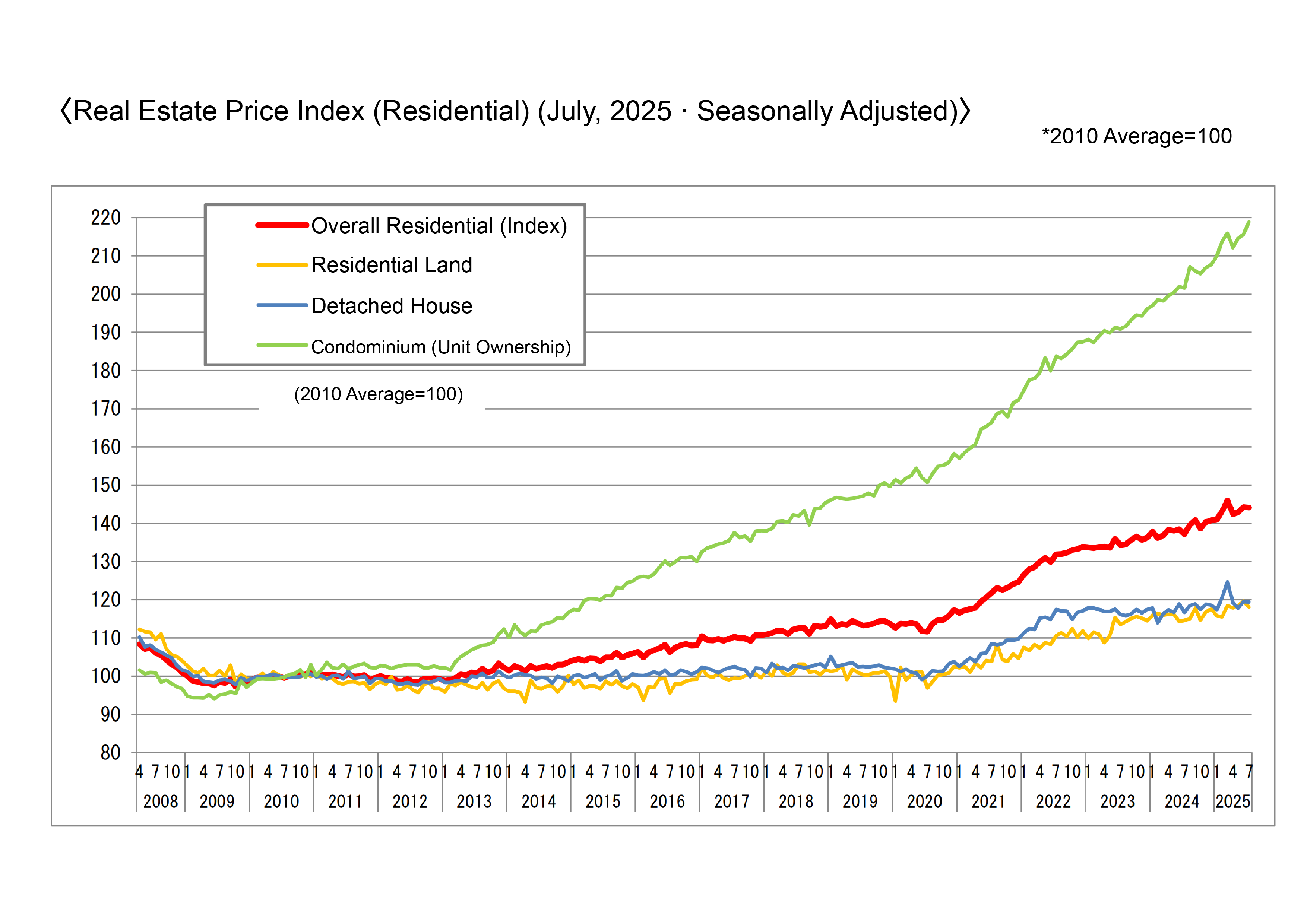

Q2 2025 Real Estate Price Index: Housing Flat, Commercial Sector Rises

The Real Estate Price Index for Q2 2025 showed contrasting trends between housing and commercial markets.

Nationwide, the Residential Price Index (seasonally adjusted) was 144.2 (down 0.1%), essentially flat. Subcomponents showed residential land at 118.0 (down 1.4%), detached houses at 119.4 (down 0.1%), and condominiums at 219.0 (up 1.5%), maintaining strong growth in urban condominium markets.

By Region

In the Kanto area, the composite residential index rose to 152.6 (up 0.8%), driven by condominiums at 215.3 (up 2.0%).

On the other hand, Kinki softened to 145.5 (down 0.6%), with residential land at 107.6 (down 15.1%), though detached homes remained resilient (124.8, up 2.9%).

Tokyo climbed to 178.7 (up 1.0%), with condominiums reaching 227.7 (up 1.5%), near record highs.

Osaka held at 152.4 (down 0.1%), but its residential land fell sharply to 109.7 (down 20.7%).

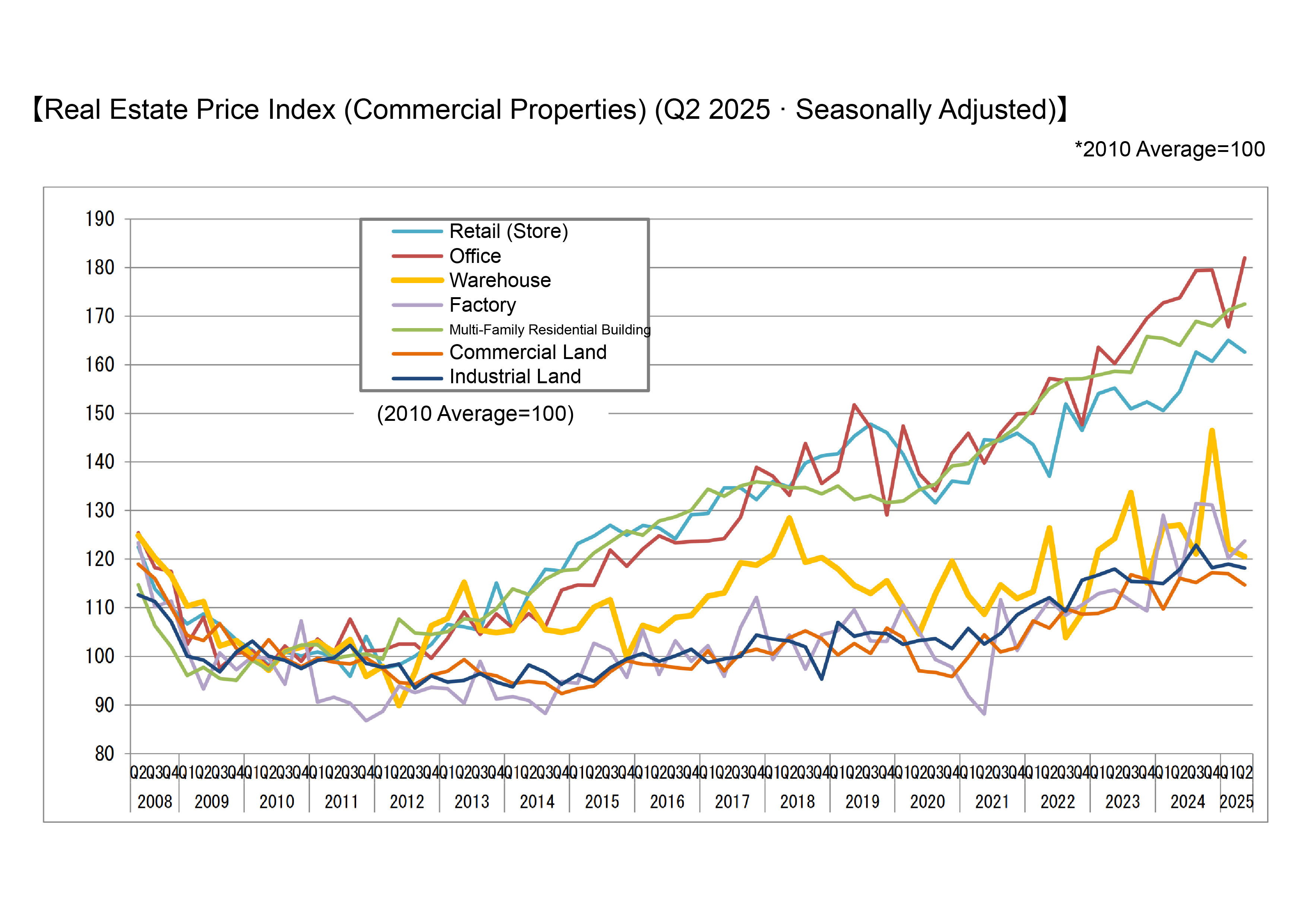

Commercial Real Estate: Office Sector Strengthens

The Commercial Real Estate Price Index rose 0.6% to 145.1. By category, offices surged 8.4% to 182.0, reflecting revived corporate demand in major cities, while stores declined 1.5% to 162.6.

In the three major metropolitan areas, offices reached 195.6 (up 13.3%), while warehouses and commercial land softened.

Housing Investment Outlook: September Down 4.2% YoY, Condominium Segment Slows

The estimated housing investment amount for September 2025 totaled 1.2855 trillion yen, down 4.2% year-on-year.

Owner-occupied housing fell 2.2%, rental housing 2.6%, and condominiums 19.9%, leading the overall decline.

After a strong FY2024 (16.3 trillion yen, +9.9%), momentum has slowed under rising costs and higher interest rates.

Foreign Ownership Regulation and Market Outlook

The new administration’s “Zero Illegal Foreign Owners” policy and tighter land acquisition screening may curb foreign capital inflows that have buoyed Tokyo and resort markets.

As a result, luxury condominium appreciation is likely to moderate, while domestic owner-occupied housing remains stable.

Future trends suggest:

- Flat-to-slightly-declining nationwide demand and investment.

- Continued strength in prime offices and urban condos, but sensitive to foreign capital policies.

- Growing regional and sectoral disparities.

- Demand shifting toward “selected, transparent, and trusted” assets.

- Need for stronger risk management and adaptive investment frameworks.

Japan’s real estate market is transitioning from expansion to adjustment. Divergence by sector and region is widening, signaling the beginning of an era where quality, stability, and credibility define success—“Selected properties” will be the winners of the next cycle.

For more information