Latest News

2026 Real Estate Market Outlook & 2025 Review in Japan

2025/12/26

Market Forecast Column

— What kind of year was 2025? —

The real estate market in 2025 was shaped by global financial market volatility. The United States began a low interest rate cycle, while capital outflows among high-net-worth individuals accelerated in China and the United Kingdom, making movements in interest rates, foreign exchange, and capital flows increasingly difficult to forecast.

In contrast to global trends, Japan began moving away from its long-standing policy of monetary easing by raising interest rates. Consequently, Japanese real estate regained attention as an international investment destination. Although Japan lacks institutional advantages such as no income tax or “golden visa” programs, it was favorably assessed for its political stability, public safety and stable assets.

Although Japan was not often selected as a relocation destination, 2025 highlighted the role of Japanese real estate—not as a market for short-term investment, but as a strategic capital allocation opportunity, determined by the timing and location of investments. As a result, land values have risen in all major districts for seven consecutive periods. This is due to a gradual economic recovery, a continued recovery trend in tourism retail demand and a weak yen. Overseas capital flowed into hotels, mixed-use commercial facilities, logistics assets, and prime location properties.

At the same time, while residential prices in central urban areas continued to rise, growth in suburban markets remained subdued, widening regional disparities. These trends are expected to serve as an important premise for understanding the real estate market beyond 2026.

This article reviews key market developments in 2025 and outlines the major issues influencing the real estate outlook in 2026. It also highlights the perspectives investors should take and the sectors that require special attention.

Global Market Shifts in 2025: Rates, FX and Capital Flows

These transactions underscore that, during the weak-yen phase, Japanese real estate has been recognized as an affordable and stable investment. In particular, overseas capital further expanded its presence in urban landmarks, logistics facilities, hotels, and data centers.

When foreign acquisitions accelerated because of weak yen, high-net-worth capital outflows continued in the U.K. and China. Although Japan lacks tax-related institutional advantages, its safety and political stability led it to be a “capital haven” or a long-term investment, but not a relocation destination.

One factor supporting this trend was growing uncertainty surrounding the U.S. economy. As of June 2025, the U.S. National Debt Surpasses $35 trillion, already standing over 120% of GDP. While nonfarm payrolls increased by 119,000 jobs in September, more than expected, the unemployment rate edged higher to 4.4%, the highest it’s been since October 2021. The data leave market sentiment divided.

With mixed economic indicators, the Federal Reserve Interest Rate Outlook is unclear. In December 2025, The Federal Reserve approved a much-anticipated quarter percentage point interest rate cut at a meeting. This decision brings the new rate to 3.50–3.75%, marking the third cut of the year. It was interpreted as a response to softer labor conditions and lower inflation.

Meanwhile, during this U.S. easing cycle, The Bank of Japan raised benchmark rates to 0.75% on December 19. Rising interest rates and higher construction costs may compress returns on real estate investments. However, with the continued weak yen and steady demand from global investors, a significant decline in foreign interest in Japanese real estate is unlikely.

What Happened in Japan’s Real Estate Market in 2025?

In 2025, Japan’s real estate market remained resilient across residential, commercial, and inbound tourism–related sectors, standing out amid the global reallocation of capital.

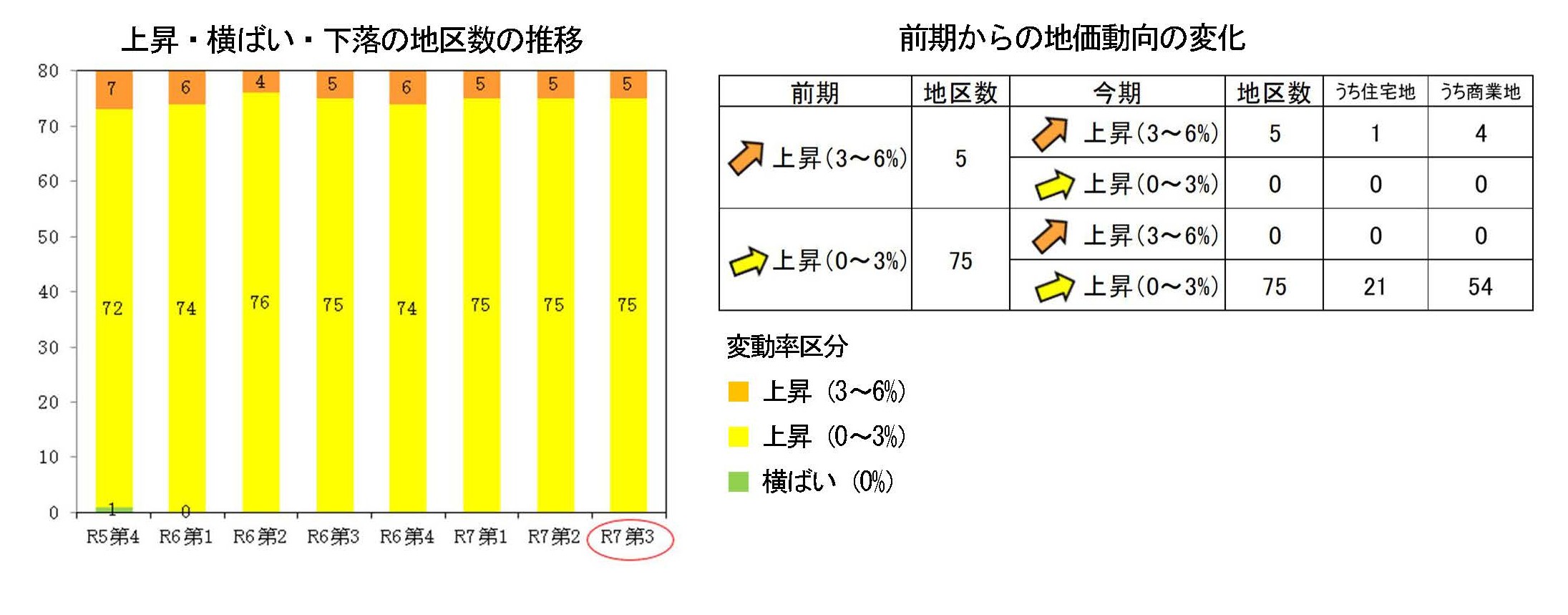

Land Prices: Seven Consecutive Periods Across Major Districts

According to the Ministry of Land, Infrastructure, Transport and Tourism’s Q3 2025 Land Price LOOK Report, both residential and commercial land prices rose for a seventh consecutive period across all major cities. In residential markets, robust demand for condominiums in districts with excellent convenience and living environments has kept prices firm. In commercial markets, Land values trended upward thanks to redevelopment and inbound tourism rising footfalls, which boosted demand for retail shops and hotels.

A notable point was the international recognition of Japan’s major cities also improved. In the 2026 World’s Best Cities Report, Tokyo placed 4th and Osaka 23rd, reflecting rising global tourism evaluations. Expanding tourism demand has supported the value of commercial facilities and hotels, reinforcing stability in Japan’s commercial real estate market.

Tourism Recovery Supports Commercial and Hotel Markets

In 2025, the inbound tourism demand recovery improved conditions in retail and hotel markets. The weak yen enhanced visitors’ purchasing power, supporting retail sales in major commercial districts such as Ginza and Shinsaibashi. Large urban commercial facilities saw strong leasing demand from domestic and international brands, vacancies were absorbed, and tenant demand was tight.

The hotel market also showed a clear recovery, with high occupancy rates in central Tokyo and airport-adjacent areas. Demand from luxury segments returned from global markets, and average daily rates continued to rise. In addition, growth in high-end long-stay demand further boosted profitability for inbound tourism-related assets.

Against this backdrop, global investor appetite has been further strengthened, and these trends have reinforced hotels and commercial facilities as key investment sectors.

Detached Housing: Central Growth and Suburban Polarization

In 2025, the detached housing market showed clearer polarization, with strong price growth in central Tokyo and slow growth in the suburbs.

In October 2025, a market analysis found that the average asking price for newly built detached homes in Tokyo’s 23 wards was ¥86.67 million. This was due to greater supply of higher-priced properties with larger sites and floor sizes.

Central Tokyo price growth (Tokyo 23 wards):

- Core 6 wards (Chiyoda, Chuo, Minato, Shinjuku, Bunkyo, Shibuya): +62.6% YoY

- Southern/Western 6 wards (including Shinagawa, Setagaya): +23.2% YoY (¥109.72 million)

- Northern/Eastern 11 wards: +6.6% YoY (¥66.71 million)

Meanwhile, average prices in the National Capital Region remained resilient, but growth was weaker away from the city center, reflecting regional diversity.

Suburban markets show different results:

- Yokohama: -12.7% MoM

- Sagamihara: -8.2% MoM

- Chiba: -2.1% MoM

- Kawasaki: +8.7% MoM

- Saitama: +5.4% MoM

For more details, sign up for a free trial membership

This article provides just a glimpse of the content available.

Exclusive member articles (4,448 words remaining): https://member.glocaly.tokyo/en/client/blog-detail/237

In addition to our outlook for the 2026 real estate market, we provide a wide range of insights covering property purchase, asset management, and essential real estate terminology.

Sign up for a limited-time free membership to gain full access!

For more information