Latest News

Hotel investment volumes will likely cross US$7 billion for the full year 2021, a 15% year-on-year increase!

2021/12/17

Market Forecast Column

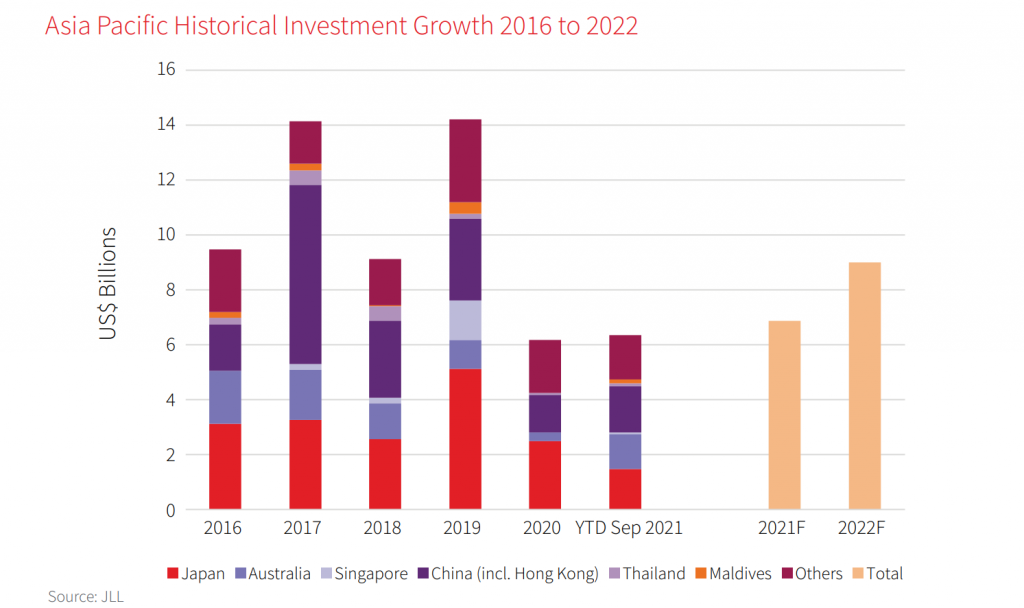

According to JLL Hotels & Hospitality Group, hotel investment volumes will likely cross US$7 billion for the full year 2021, a 15% year-on-year increase, as investors continue to look past the industry’s short-to-medium term headwinds brought on by COVID-19.

In JLL Hotels & Hospitality Group Asia recently published Hotel Investment Highlights 2H21, healthy transaction volumes will continue into next year, with the industry expected to attract a minimum of US$9 billion in capital in 2022.

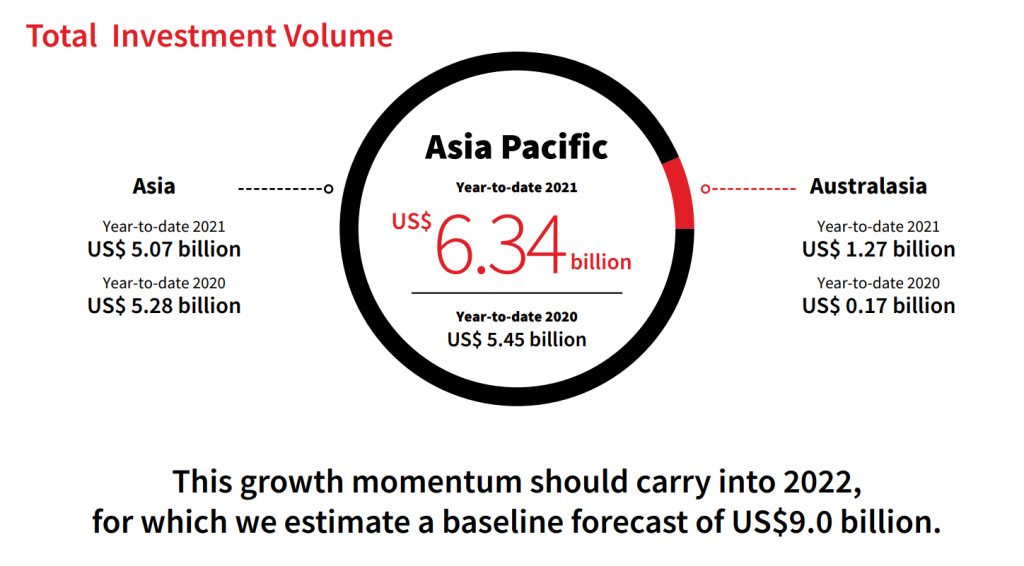

The analysis shows that year-to-date 2021 volumes have totaled US$6.34 billion. Investment in the region has been spread across 127 transactions and 12 countries, representing approximately 21,000 keys. However, average price per key has declined year-on-year according to JLL, decreasing to US$303,000 to $369,000.

China stands as the most active investment market

Activity in 2021 has been dominated by transactions in China, Japan and Australia, which year-to-date have accounted for 67% of total volume in the Asia Pacific. China currently stands as the most active investment market in the region, with US$1.52 billion in sales in the year to date, Japan, long the number one destination for regional hotel investment, attracted the second largest amount of capital, despite seeing a decline in year-to-date transaction volume, with US$1.48 billion in hotel transactions. Australia was the third most active market, accounting for US$1.26 billion in investments in 2021 thus far.

Japan remains a force to be reckoned, despite a decline in year-to-date transaction volume, with US$1.48 billion in hotel transactions. Australia rounds up the region’s Big Three with US$1.26 billion. Driven by strong domestic investor demand, together they account for 67 per cent of total volume across Asia Pacific.

Even as economies continue to experience the fallout from pandemic restrictions and border controls, vaccine rollouts across the region are expected to boost recovery and tourism for a sharper business cycle rebound. Just as the Olympics reminded all of us that there is strength in adversity, the resilience of the hotel investment market is a clear sign that things can only get better from here on.

“In our interactions, buyers are viewing the external backdrop as the start of a new investment cycle for the hotels space. However, the region remains characterised by a sizeable bid-ask spread, as owners are bolstered by relatively low gearing and strong lender relationships. As a result, sellers are holding for higher pricing while waiting for market conditions to improve.” says Nihat Ercan, Senior Managing Director, Head of Investment Sales, Asia Pacific, JLL Hotels & Hospitality Group.

GLOCALY selected excellent investment properties

Excellent location! A business, travel, and sightseeing base in Higashioi, Shinagawa, Japan – a Long-stay apartment hotel

Long-stay apartment hotel with kitchen. There are 3 rooms in total, which can also be changed to leased real estate for residential use.

In 2027, the Chūō Shinkansen at Shinagawa Station is expected to open. Therefore, this is a newly developed area that is now attracting attention.

It is a 2-minute walk from Tachiaigawa Station on the Keihin Kyuko Railway. Although it is close to the station, its quiet living environment is one of its attractive point.

For more details, please visit GLOCALY member page! More information is waiting for you!

For more information